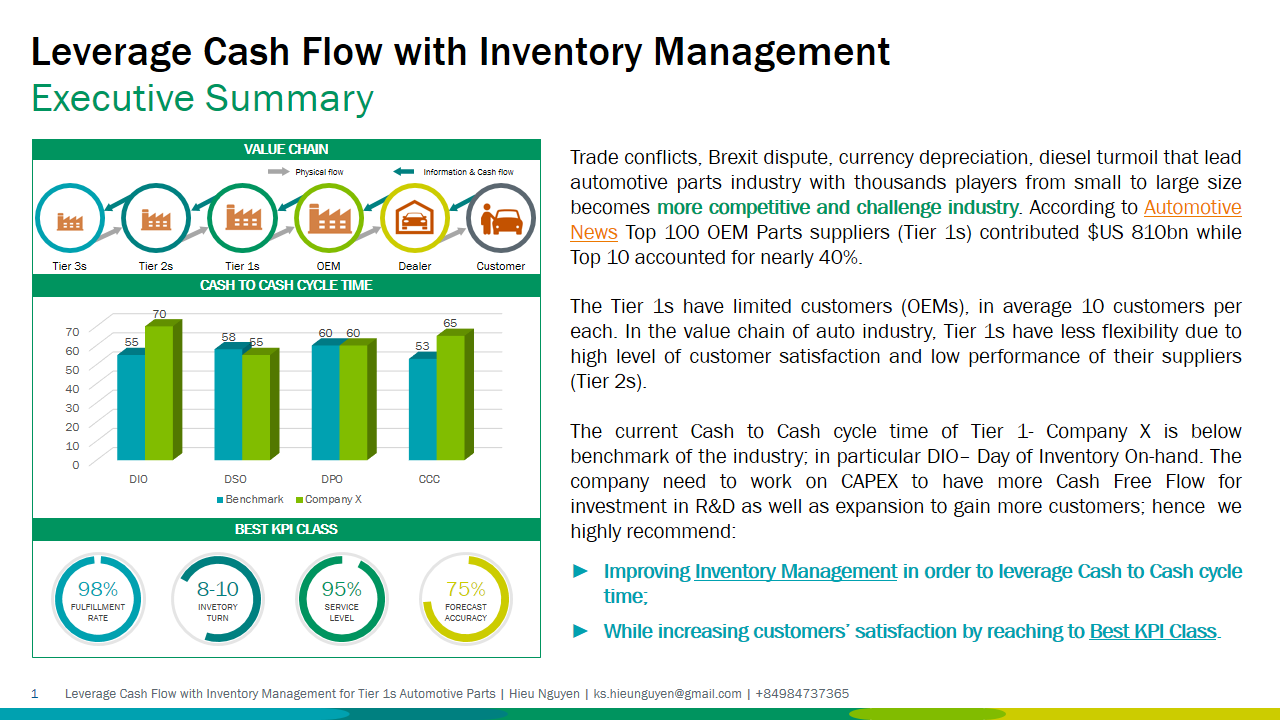

Effective Working Capital and Cash Flow Management is one of key financial targets of top companies because Working Capital (the speed at which assets can convert into cash) has always been crucial to the long-term financial health. As the top management of company, how often do you check your company health-deck? The most easy way to check the effectiveness working capital that is look at Inventory level of the company.

This article is fictitious case based on working experience of the author, it can be take as an example (framework) for your company to optimizing Cash Flow with Inventory management.

This article is fictitious case based on working experience of the author, it can be take as an example (framework) for your company to optimizing Cash Flow with Inventory management.

Comments

Thank you for explanation.

Moolamore is an advanced accounting application that analyzes, manages, and projects real-time transaction data. Using our cash flow forecasting software and app, you can forecast and estimate your company's future financial position. Financial Management